Diwali is the time for buying, and COVID-19 or not, Indians have been buying, ecommerce ploughing the way for high sales, and further future growth, despite inflation.

Sales crossed INR1.25 trillion this Diwali, with retailers logging decade-high sales and already looking forward to the upcoming Indian wedding season.

Read more: Global supply chain crisis: Brace for impact this Diwali

Ecommerce companies led the way in the first week of online festival sales in October, with 23% YoY sales growth in 2021. According to RedSeer Consulting, this spells out to US$4.6 billion (INR32,000 crore) worth of goods sold online, Flipkart leading with a 64% market share.

Amazon reportedly saw the highest-ever shopping activity for its sellers and brand partners. The ecommerce giant saw participation from 99.7% pin codes. Local shops on Amazon registered double growth selling over 10 products per minute.

Consumers Apply Basket & Sales Strategy During E-Commerce Sales

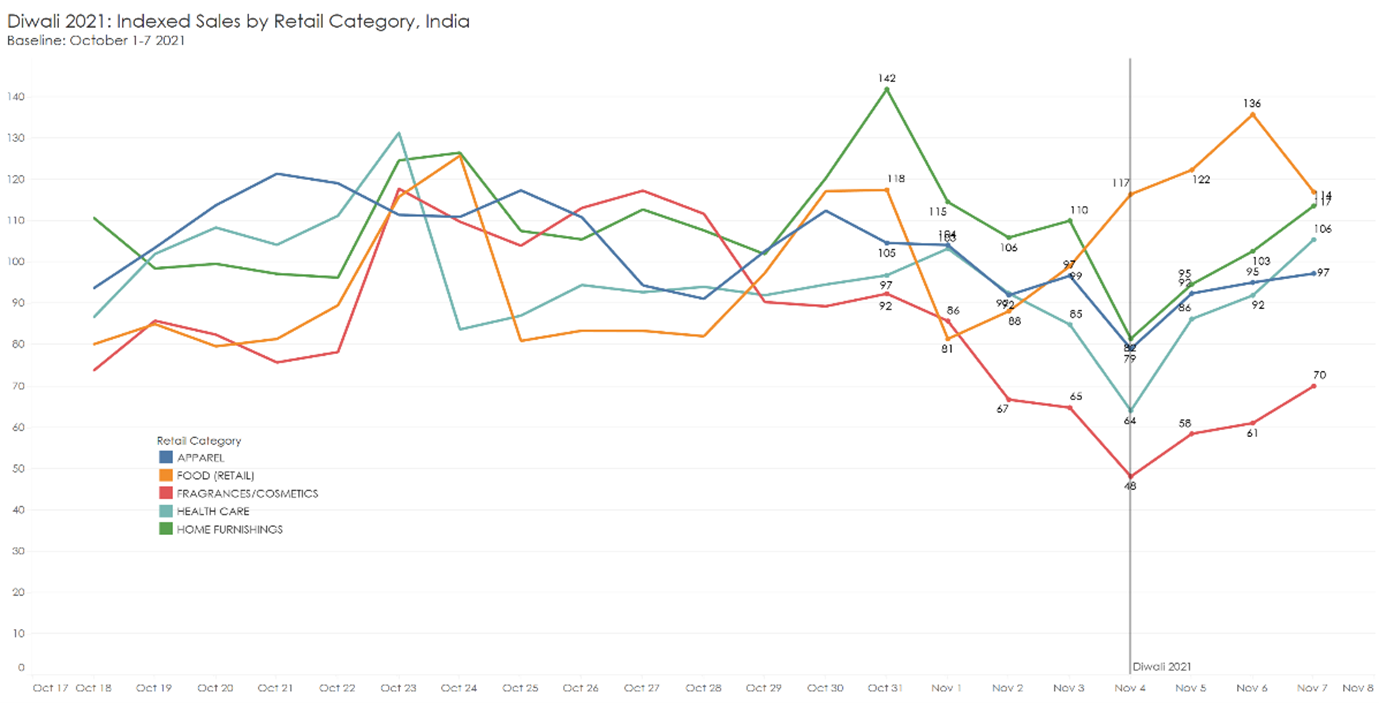

Criteo, an advertising company that provides online display advertisements released the findings from the 2021 and 2020 festive seasonality data. According to the 2021 data, home furnishing and food topped the list of the most popular shopping categories with +42% and 18% sales five days before Diwali.

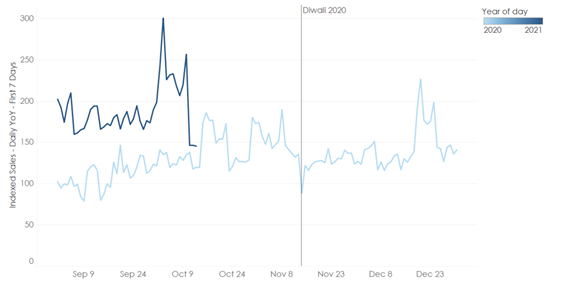

Also, this year marketers witnessed an early shopping hype pre-Diwali starting late September 2021, compared to mid-October in 2020. The highest peak observed during the period of the Big Billion Days was on 3rd October 2021, representing an overall Y-O-Y daily sales of 200% with the first seven days of September 2020 as a baseline.

The Indian e-commerce industry had seen a categorical upsurge, enabling marketers to invest more in digital advertising including mobile marketing

Taranjeet Singh, Managing Director of Southeast Asia and India, Criteo, said, “The Indian e-commerce industry had seen a categorical upsurge, enabling marketers to invest more in digital advertising including mobile marketing.

“We observed that consumers apply the basket and sales strategy during e-commerce sales specifically for the Big Billion Days period, wherein consumers place their items into shopping carts prior to the date of sale and complete their transaction while the platform commerce sale goes live.

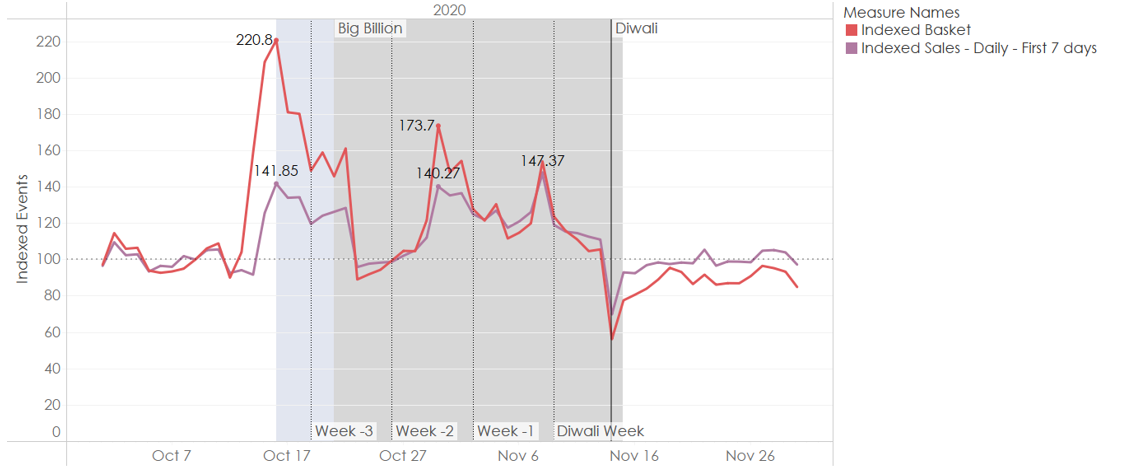

“In Criteo’s 2020 data, it can be seen that people started to look into items approximately three days before, recording 120.8% in the indexed basket.”

Indexed Daily Basket & Sales Events, 2020 (Baseline: first 7 days of October 2020)

The 2020 and 2021 data additionally reveal deeper insights on the evolving e-commerce trends expected this year:

With September 2020 as a baseline, approximately 86% pre-Diwali daily sales were noticed in October 2020, whereas 2021 detected 200% of daily sales in the end of September, marking the beginning of the Big Billion Days period.

Indexed Daily Sales of 2021 & 2020 (Baseline: September 2020)

Five days before Diwali 2021 demonstrate an increase in the buyer’s retail shopping interest. Home furnishing and food led the festival with respectively +42% and +18% sales (with First 7 days of October 2021 as a baseline).

Diwali 2021 Indexed Sales (Baseline: First 7 days of October 2021)

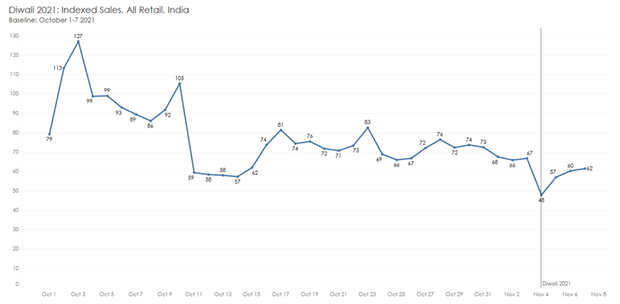

With the first seven days of October 2021 as a baseline, festive shopping started one month prior to Diwali in 2021, with +27% spike.

For the rest of October, the sales remain moderate, however, there are two small increases around October 17th and 23rd, although it didn’t exceed the trend observed at the beginning of the month.

Indexed Sales in 2021 (Baseline: First 7 days of October 2021)

eCommerce Growth Stimulates Trade Despite Inflation

This growth in ecommerce will stimulate trade to push up further growth, such as B2B cross-border payment transaction values, which an August Juniper Research report predicted to be 25%+ by 2026.

The research indicated that as cross-border ecommerce speeds up, B2B payments need to align with usage of automation, instant payment rails and solutions such as virtual IBANs, which enable acceptance of local payment options, critical to future success.

This growth can be seen as a sign of resilient demand even as inflation remains high. As Business Standard quoted the Confederation of All India Traders (CAIT), which represents about 70 million traders, said, ‘the tremendous sales response came as a much-needed breather for retailers facing a slowdown for the past two years. It has also made businesses optimistic about the near future.’