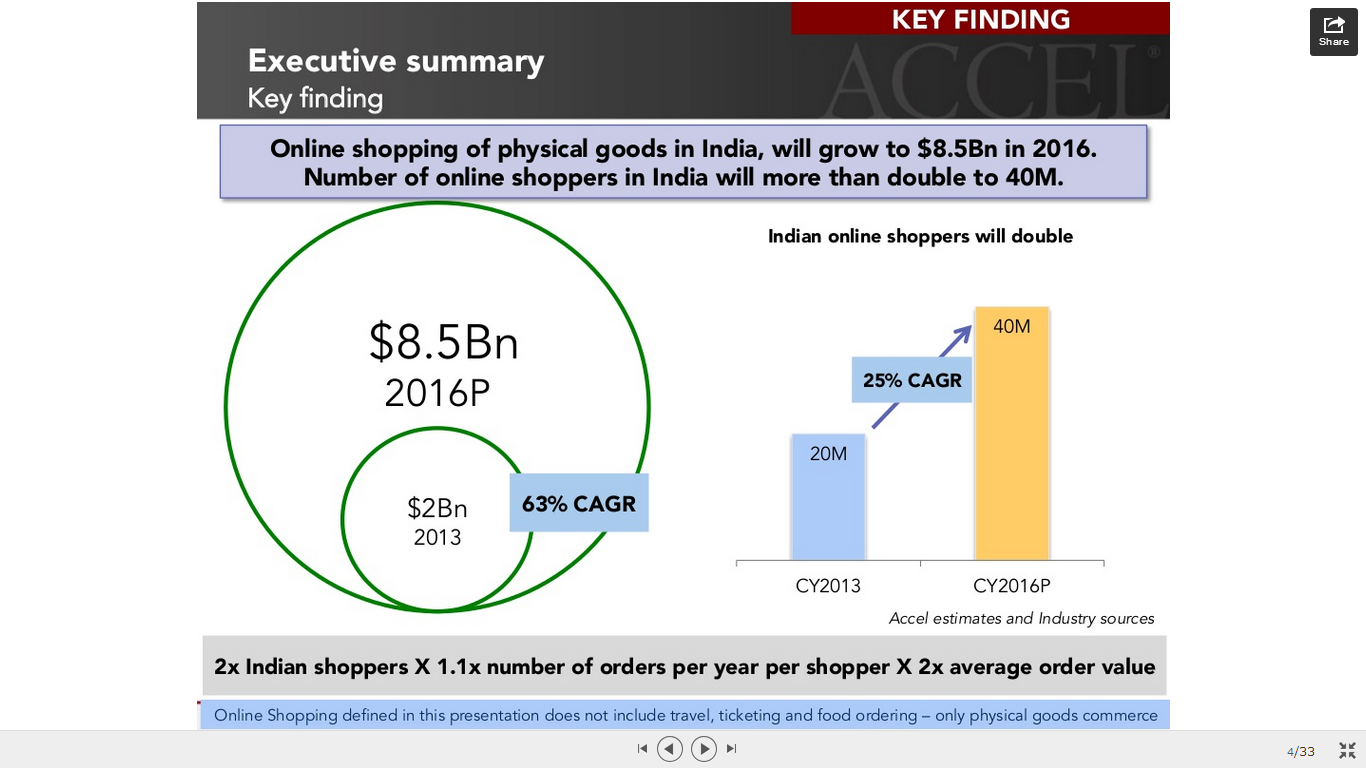

Accel India, is a venture and growth equity firm and funds companies from inception through the growth stage. It is famous for it’s investments in Flipkart, Myntra and BookMyShow. The team have come up with some key insights into how the industry is transforming itself. For the purposes of report, online shopping covers only physical good commerce, and does not include travel, ticketing and food ordering. Below are the salient features from the report –

- Online Shopping of Physical Goods will increase from $2B in 2013 to $8.5B in 2016

- Only 17% of Indians are online, out of which 9% shop online, compared to >30% in other countries

- Last Year was the rise of fashion category – fashion e-commerce GMV doubled since 2012

- 35% of online GMV in 2016 will be influenced by women

- New Shoppers will come from 40M shoppers in the age group 19 – 24

- 3rd Party payments will become significant alternative to Cash on Delivery

- Online retail is still very small portion of retail , with books in the leading : 4% in mobiles,0.2% in jewellery, 7% in books and 1% in fashion and footwear

The report lists reasons such as e-tailers not having mobile optimized sites for not having 1:1 conversions between traffic to mobile. Entrepreneurs like Annkur Agarwal echo similar sentiments, saying that product startups should build mobile first, providing evidence through PriceBaba.com’s monthly visitor stats – 51% of 1.8 million monthly visitors use a mobile browser.

The top 3 e-commerce states, according to the report are Delhi-NCR, Karnataka and Maharashtra. It’s no surprise that Delhi, Bangalore and Mumbai are also the top 3 startup destinations in India, the effect is now visible in customer behavior as well. Larger states such as Bihar and Chhattisgarh are waiting for the right infrastructure to pick up.

In a recent interview, Subrata Mitra, Partner at Accel Partner tells the below on what keeps him awake at night –

What keeps me awake is the number of people (in India) who have ever shopped online for physical goods from an e-commerce store; it’s around 20 million. Also, the average basket size of Indian’s shopping online is one sixth of China. The total market size of physical goods in e-commerce was $2 billion in 2013. If this market does not get to about $20 billion—which is not big since the US is a $250 billion market while China is about to cross $250 billion—we will not reach critical mass and maybe all of these companies will start tapering at some point.

But if it starts getting to $10 billion and beyond, I think Myntra, Flipkart and even Snapdeal could succeed.

Given the massive amounts of funding Flipkart and the likes have managed to raise, and new e-tailers coming up in varied and nice sectors, we predict that the growth is definitely upwards. But, the mushrooming of e-commerce portals does not help, as they constantly battle with price reductions, higher operational costs and digital visibility issues. Let’s wait and watch on Flipkart and Myntra, as the recent news still hints on the possible merger.

Here is the detailed slideshare of Accel Partner’s findings on Indian e-commerce :

[slideshare id=33017305&doc=accel-india-ecommerce-mar14-140401225936-phpapp01]